dwh,

It's perhaps natural enough that many participants on ExPo are worried about America's manufacturing health, because this discussion forum is so dedicated to

stuff, to the tools and machines that make overlanding possible.

Again, I know that we're not supposed to get “political” on ExPo, but the question of American manufacturing decline seems to come up often. So I thought I'd add my two cents worth. My perspective might prove a bit different, because I am an Anglophonic German who is familiar with the contrasting German experience. And because my ways of thinking about the problem tend to be more sociological and structural, as opposed to merely moral or political.

Hope that what follows below passes muster with the ExPo censor!

***************************************

***************************************

1. A Few Thoughts on Manufacturing Decline in Anglosphere Countries: CME versus LME

***************************************

Earlier in the thread I indicated that I have both German and Canadian passports, and that I strongly favor the Germanic and Nordic "

CME" model of collaborative, co-ordinated market capitalism, as opposed to the "

LME" of liberal-market capitalism that one finds mainly in Britain and the United States -- see post #305 on page 31 for some discussion of the same, at

http://www.expeditionportal.com/for...pedition-RV-w-Rigid-Torsion-Free-Frame/page31 (standard ExPo pagination).

For some background on the contrast between these two models of advanced capitalism, usually called the "

Varieties of Capitalism" thesis, see

http://en.wikipedia.org/wiki/Varieties_of_Capitalism ,

http://www.amazon.co.uk/Varieties-Capitalism-Institutional-Foundations-Comparative/dp/0199247757 ,

http://digamo.free.fr/hallsosk.pdf ,

http://www.lse.ac.uk/government/whosWho/profiles/dwsoskice@lseacuk/Hall-Soskice-Intro-VoC-2001.pdf ,

http://www.cerium.ca/IMG/pdf/HALL-_...introduction_to_varieties_of_capitalism-2.pdf ,

http://isites.harvard.edu/fs/docs/i.../Hall - Soskice - Varieties of Capitalism.pdf ,

http://ukcatalogue.oup.com/product/9780199247752.do ,

http://scholar.harvard.edu/hall/pub...stitutional-foundations-comparative-advantage ,

http://nez.uni-muenster.de/download/Literaturbericht_Dominik mit Deckblatt.pdf , and

http://myweb.rollins.edu/tlairson/pek/varietycapit.pdf .

Probably the best introductions to the

CME versus

LME distinction are two recent BBC "

Analysis" podcasts:

A.

http://www.bbc.co.uk/programmes/b01cvkg6 ,

https://player.fm/series/analysis/analysis-neue-labour-02-mar-12 ,

http://downloads.bbc.co.uk/podcasts/radio4/analysis/analysis_20120305-2100a.mp3 ,

B.

http://www.bbc.co.uk/programmes/b0477nry ,

https://player.fm/series/analysis/analysis-varieties-of-capitalism-23-june-2014 ,

http://downloads.bbc.co.uk/podcasts/radio4/analysis/analysis_20140623-2100a.mp3

If you really want to understand the differences between Anglo-American capitalism versus Continental-European capitalism, and the socio-political differences that underpin both, these podcasts are terrific places to begin. They cannot be recommended too highly.

One important feature of the

CME model is an apprenticeship system that educates for the needs of industry – see

http://www.bbc.co.uk/news/14185334 ,

http://www.bbc.com/news/business-16159943 ,

http://en.wikipedia.org/wiki/Dual_education_system ,

http://en.wikipedia.org/wiki/Apprenticeship ,

http://www.make-it-in-germany.com/en/working/prospects-in-germany/vocational-training-in-germany/ ,

http://www.young-germany.de/topic/s...side-germanys-dual-vocational-training-system ,

http://www.independent.co.uk/news/u...nstyle-vocational-qualifications-8193166.html ,

http://www.economist.com/blogs/bagehot/2011/11/britains-labour-market ,

http://www.thisismoney.co.uk/money/...y-looks-UK-European-countries-skills-gap.html ,

http://www.dailymail.co.uk/news/art...rk-study-offer-lure-brightest-youngsters.html .

But Germany's apprenticeship system is only just one component. As all sophisticated observers seem to agree,

CME countries have a tightly interwoven, complex and mutually reinforcing system of institutions and values: see

http://www.economist.com/node/21552567 ,

http://www.economist.com/news/busin...d-germanys-it-not-so-easy-copy-german-lessons ,

http://www.economist.com/blogs/newsbook/2013/06/special-report-germany ,

http://www.economist.com/news/speci...success-are-more-complex-they-seem-dissecting ,

http://www.economist.com/news/speci...y-europe-needs-rethink-way-it-sees-itself-and ,

http://www.economist.com/news/speci...e-requires-new-kind-germany-overcoming-demons ,

http://www.economist.com/node/21552579 http://www.theguardian.com/world/2013/jun/01/germany-champion-europe , and

http://www.economist.com/sites/default/files/special-reports-pdfs/15656906.pdf .

Another major component of Germany's

CME model is the "

Mittelstand", family-owned medium sized business that focus on high-value-added manufacturing, in top-end market niches where global competition is minimal or non-existent – see for instance

http://en.wikipedia.org/wiki/Mittelstand ,

http://www.economist.com/blogs/schumpeter/2012/04/germanys-mittelstand ,

http://cambridgemba.files.wordpress...d-the-thriving-middle-class-the-economist.pdf ,

http://www.economist.com/node/18061718 ,

http://www.economist.com/node/17572160 ,

http://www.economist.com/node/21524922 ,

http://www.economist.com/news/busin...ing-both-sides-mittelstand-and-middle-kingdom ,

http://www.economist.com/news/business/21564898-envy-germany's-medium-sized-family-firms-sparks-desire-emulate-them ,

http://www.gsk.de/uploads/media/Meet-the-Mittelstand_22.01.2014.pdf ,

http://www.bmwi.de/English/Redaktio...erty=pdf,bereich=bmwi,sprache=en,rwb=true.pdf , and

http://www.gtai.de/GTAI/Content/EN/...ago-gtai-german-mittelstand-bremer-121025.pdf .

But the Mittelstand only works because of the apprenticeship education system, and the apprenticeship education system only works because of the Mittelstand. It's a classic chicken-and-egg-problem: which came first? The answer is that both did, co-evolving in tandem over the last 100 years, in concert with all of the other features of Germany's

CME model. The second BBC podcast does a very good job explaining how a country's politics, society, economics, system of education, and historical experience – i.e. literally everything – forms a tightly integrated and mutually reinforcing "network". So it would be naive to try to isolate just one factor as explaining recent German economic success.

The apprenticeship system and the Mittelstand in Germany are certainly important, but so too is Germany's history of non-adversarial management/worker relations, high levels of unionization, and worker participation in management decision-making via works councils or direct representation on corporate boards. Ergo "

collaborative" or "

co-operative" market capitalism, or what the Germans like to call

"co-determination" -- see http://en.wikipedia.org/wiki/Codetermination_in_Germany .

In Germany the power-gradient between labor and management is relatively "flat"; there is a much lower multiplier between worker's pay and CEO pay than in the Anglosphere, where American CEOs typically make 331 times as much as average workers; and in Germany employees are not automatically laid off in a downturn, if only because their specialized skills might prove invaluable when the economy picks up again –

see http://www.forbes.com/sites/frederi...-while-paying-its-auto-workers-twice-as-much/ ,

http://www.forbes.com/sites/kathryn...rs-774-times-as-much-as-minimum-wage-earners/ , and

http://gawker.com/5928298/its-time-to-tie-executive-pay-to-worker-pay .

Furthermore, in Germany companies and banks have a long-termist attitude towards investment, the capitalist class still has a strong sense of paternalistic

"noblesse oblige", manual labor is valorized and credentialized via the apprenticeship system, and there is a comparative absence of Anglophonic white collar / blue collar snobbery..... The list of contributing factor is almost endless. Above all, in Germany's more "artisanal" form of capitalism, the Engineer is still King, and his family has typically owned the business for generations. German manufacturing companies exist to make things and employ people over the long-term, not merely to generate profits for shareholders short-term.

All of these bits and pieces work as an integrated whole, with work-place egalitarianism in

CME countries reinforcing respect for the apprenticeship system, which in turn inclines bright, ambitious young people to consider an apprenticeship instead of university, and so on. And workplace egalitarianism reinforces support for other kinds of egalitarianism, in housing, salaries, health care, etc. One feedback loop reinforces another, and the overall consequence is a highly egalitarian society with an excellent GINI coefficient. Whereas in

LME countries, all the economic and sociological feedback loops seem to operate in reverse, with different kinds of inequality feeding off each other, and only making overall inequality worse and worse with every passing year.

The second BBC

Analysis presenter then suggests that a society has to choose between one or the other; it cannot have bits and pieces of both. It has to decide whether it wants to have a "co-ordinated, collaborative market economy" (

CME), or a "liberal market economy" (

LME). There is no half-way house possible in between.

***************************************

2. Manufacturing in Germany, and Financialization in Britain

***************************************

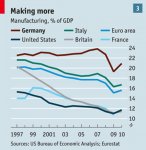

One immediate consequence of the

CME model is that manufacturing continues to be important in Germany, Austria, and the Nordic countries.

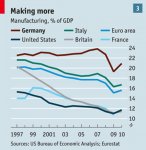

To be sure, in Germany manufacturing as a percentage of GDP has declined since the 1970's, just like all other advanced-capitalist countries. But in

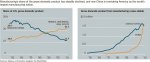

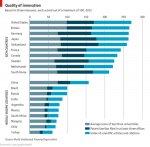

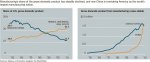

CME countries manufacturing has declined less. In the following graph German manufacturing as a percentage of GDP since 1990 has tended to mirror Japan's, declining gradually but not dramatically, and still hovering in the 20 % range:

See

https://www.gov.uk/government/publi...unity-and-challenge-for-the-uk-summary-report .

According to this graph, in the United States manufacturing seems to have held more or less steady since 1990 at 15 % of GDP, whereas in the UK manufacturing has fallen from 18 % to about 12 % of GDP.

Of course, some might say that in the United States manufacturing as a percentage of GDP is now nearer 12 % as well:

See

http://www.economonitor.com/thought...rgy-production-bring-back-manufacturing-jobs/ ,

http://www.economist.com/node/21552567 ,

http://www.economist.com/node/18484080 , and

http://www.laserfocusworld.com/blogs/opto-insider-blog.html .

However, it's important to remember that even though manufacturing as percentage of total U.S. GDP has declined, in absolute terms it continued growing right up to the 2008 crisis. The fourth graph immediately above illustrates this nicely. It's just that other sectors of the U.S. economy have been growing more quickly, hence the decline in overall percentage.

Those are the figures for manufacturing as a percentage of GDP; there also exist figures for manufacturing as a percentage of employment. Here to some extent it depends on how one defines

"employment in manufacturing". In an article written in 2005,

The Economist stated that less than 10 % of American workers is employed in manufacturing. And the figure might be even lower, because

"perhaps half of the workers in a typical manufacturing firm are involved in service-type jobs, such as design, distribution and financial planning, [and so] the true share of workers making things you can drop on your toe may be only 5%." See http://www.economist.com/node/4462685 .

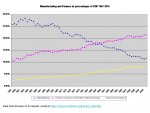

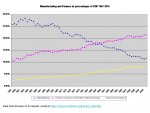

The most dramatic decline for employment in manufacturing took place in Britain, where it dropped from 35 % of the workforce in 1970, to just 14 % in 2005:

Only in Italy and Germany did employment in manufacturing remain above 20 % of the workforce. Since 1990, in Eurozone countries as a whole employment in manufacturing has dropped only 5 %, in marked contrast to much steeper declines in the United State, Britain, and Japan:

The Economist is a decidedly

LME sort of publication, so as one might expect, the article went on to argue that there's no cause for Anglospheric alarm. And much of the arguments made by the article seem sensible enough. For instance, although manufacturing output has continued to grow in the Anglosphere, employment has remained steady or shrunk, because of increasing productivity. The analogy here is always to agriculture: only roughly 4 % of Americans now engage in farming, feeding the remaining 96 %, because farming has become so automated and productive. As manufacturing becomes ever more roboticized, the argument goes, the same or fewer workers should be able to produce 2 times, or 5 times, or 10 times more "stuff". Whereas it is much harder to automate services, ergo, the comparative size of services in today's advanced capitalist economies.

All of this is of course true, but it also fails to appreciate the obvious. If manufacturing does not just become more productive, but actually disappears altogether, because it has decamped to Third World countries, then even the more automated kind of manufacturing won't be around anymore to generate ancillary "spin-off" economic activity in services like design, marketing, transport, finance, banking, etc. If a country becomes "overfinancialized" and "overserviced", as Britain did in the 1990's and 2000's, then what does it have left to sell the rest of the world? What can it export, in exchange for the manufactured goods that are now being produced elsewhere?

In the case of Britain, the rarely explicitly stated but widely held assumption was that Britain would export "financial services". London would capitalize on its strength as a center of global finance, as a kind of super-sized Cayman islands. But this only works, of course, as long as London remains attractive as a place for foreigners to do their banking, brokering, financial management, speculating, etc.

Much of this sort of financial activity in Britain depends on foreign good will and enthusiasm for whatever "financial services" or special tax status Britain seems willing to provide, for instance, non-dom residency for foreign billionaires. This sort of financial activity can disappear in a heartbeat if foreign sentiment turns against Britain. Sure, Britain's industrial decline is no cause for concern just as long as foreign corporations and billionaires are still willing to imagine London as their financial capital. And the theory of comparative advantage suggests that every country should rest content to specialize in whatever it does best, engaging in trade with others who do things better in x, y, or z sector. As such, the argument goes, the Indians and the Chinese should focus their minds on mundane matters of manufacturing, and leave the white-collar world of high finance to the Oxbribdge and Ivy-League educated experts in the Anglosphere, in New York and London.

But finance is not like other economic activities, because it is so central to a country's well-being. Outside intervention in currency markets, for instance, can play havoc with a country's exchange rates and its export industries. No doubt the Anglosphere is quite content with continuing Anglospheric financial and banking hegemony, and the ability of a handful of Anglosphere merchant banks to wreck the economics of Third-World countries. But it seems a bit foolish to bet the economic future of one's own country on the premise that countries outside the Anglosphere are equally happy with this state of affairs. And yet British economic policy over the last 20 years has been based on a premise as implausible as this.

Other countries are not "happy" with Anglospheric financial hegemony, they never have been, and they never will be. If China ever gets the chance to displace the dollar with the yuan as the world's reserve currency, or if India gets the chance to do something similar with the rupee, only a fool would think they would not seize the opportunity. It also seems obvious that eventually the Chinese, Indians, and Arabs will want to build up major financial centers and expertise of their own, in Shanghai, Mumbai, and Dubai. And if and when they do, and if they come to feel that they no longer need London, what is Britain left with to sell?

And what it this kind of change in foreign sentiment is happening right now, and explains why Britain has found it so hard to shake off recession?

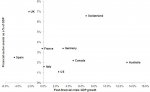

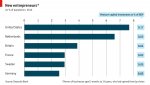

Here are a few graphs that suggest just how comparatively over-financialized Anglosphere economies have become:

For more about financialization, in Britain as well as the United States, see

http://en.wikipedia.org/wiki/Financialization ,

http://www.theguardian.com/business...don-financial-centre-boost-or-harm-uk-economy ,

http://www.theguardian.com/business...4/uk-economy-seven-things-need-to-know-ons-g7 ,

http://www.cityam.com/article/financial-services-firms-account-96-cent-uk-s-gdp ,

http://www.pbs.org/moyers/journal/09282007/watch.html ,

https://thecurrentmoment.wordpress.com/2011/07/page/2/ ,

http://www.huffingtonpost.com/william-k-black/how-the-servant-became-a_b_318010.html ,

http://www.theatlantic.com/magazine/archive/2009/05/the-quiet-coup/307364/ ,

http://www.washingtonpost.com/wp-dy.../03/11/AR2009031103218.html?wpisrc=newsletter ,

http://www.peri.umass.edu/fileadmin/pdf/working_papers/working_papers_151-200/WP153.pdf ,

http://www.peri.umass.edu/fileadmin/pdf/programs/globalization/financialization/chapter1.pdf ,

http://www.economicshelp.org/blog/7472/economics/over-financialisation-of-the-economy/ ,

http://www.ippr.org/publications/dont-bank-on-it-the-financialisation-of-the-uk-economy ,

http://speri.dept.shef.ac.uk/wp-con...-Heel-of-Anglo-American-Caplitalism-754KB.pdf , and

http://monthlyreview.org/2008/04/01/the-financialization-of-capital-and-the-crisis/ ,

http://monthlyreview.org/2007/04/01/the-financialization-of-capitalism/ .

The following short blog entry, written by an Austrian economist in 2009, summarizes Britain's dire straits nicely:

Today the British economy is in a mess: North Sea Oil is running out, the manufacturing sector has been reduced to minimal size where supply chains rely on imports, because many semi-finished products are no longer produced in Britain; the financial sector is no longer sustainable in its size and needs to be reduced, but no master plan for substitute value-added is available; the public budget deficit reaches double-digit amounts and the danger of future hyper-inflation or even a public sector default is not negligible. A general election is looming, and so far neither party has come up with a viable plan for the future. Both parties have strong ties to the financial industry, Labour because they promoted its recent rise to dominance, the Tories because many in the highest ranks of the financial sector are their supporters, not only at the polls, but also financially.

See

http://kurtbayer.wordpress.com/2009/12/07/from-de-industrialization-to-de-financialization/ . At the level of analysis, this blog entry is just as prescient now as it was in 2009, even if in terms of policy recommendations it falls short.

The contrast here will be with continental-European countries where banking and financial services constitute a more sensible proportion relative to overall GDP, and where they function merely as very boring "utilities" that serve the real economy. In

CME countries it is considered obvious that banking should

not be the "main event", and that banking and financial services only exists to serve other sectors. Furthermore, in

CME counties it is considered obvious that banking should serve innovation in the real economy, and should not be allowed to recklessly innovative itself. After all, what is the "value added" when banking and financial services become so innovative, that their near-meltdown nearly destroys the rest of the economy? In

CME countries, all of this is as obvious as 2 = 2 = 4. And it is indicative of just how strange and a bit out of touch with economic "reality"

LME countries have become, that for many economists and other kinds of policy specialists in

LME countries today, this is no longer obvious at all. Sure, in a globalized world economy it is impossible for advanced capitalist countries to hang on to low-value-added, labor-intensive manufacturing, for instance, textiles. But that's not the kind of manufacturing that Germany does today. Germany circa 2014 manufactures and exports the very-high-valued-added goods that a country like China still cannot make.

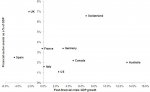

Now given Germany's comparative economic health since the 2008 crisis, the immediate economic benefits of a

CME economy are real enough. But for many

CME advocates, the sociological consequences are just as important. The

CME model continues to provide good jobs for people who did not attend university, and again, the complex web of institutions and values of

CME countries work together to promote greater equality. Ergo,

CME countries tend to have excellent GINI coefficients.

***************************************

3. The United States will probably remain LME, but perhaps not Britain

***************************************

For economic equality, the upshot is then this: it's quite possible that massive inequality is now virtually inevitable in the United States, because it has a political economy that is so heavily

LME, instead of

CME. So for the United States to become a more egalitarian society again, it would have to completely overhaul its entire political economy. That's not going to happen any time soon in the United States, although it might happen in Britain, if Ed Miliband's particular brand of Labor gains power.

Ed Miliband, Labor's current leader, is explicit and forthright about his admiration for the German economic model, and he wants British capitalism to become more Germanic, i.e. more

CME. And it's not just Ed Miliband: the "

Varieties of Capitalism" thesis is now central to the platform of the Labor party as a whole in Britain. For extensive discussion in the press, see

http://www.independent.co.uk/voices...wants-us-to-be-more-like-germany-6699327.html ,

http://labourlist.org/2013/08/could-the-german-economic-model-could-be-ed-milibands-big-idea/ ,

http://www.bbc.com/news/business-18868704 ,

http://www.spiegel.de/international...rmany-as-an-economic-role-model-a-898399.html ,

http://www.theguardian.com/politics/2012/jun/01/labour-policy-chief-germany-inspiration ,

http://www.bbc.co.uk/news/business-17213556 ,

http://www.newstatesman.com/politics/2014/01/two-big-lessons-uk-germany-and-nordics ,

http://www.theguardian.com/commentisfree/2013/feb/06/germany-success-humanity-medium-firms ,

http://www.bbc.com/news/uk-politics-17300246 , and

http://www.bbc.com/news/magazine-18432841 .

Britain's current Labor party is so pro-Germanic, that the press has dubbed it "

Neue Labor".

But again, sophisticated observers suggest that the choice here is a really an all-or nothing: either an economy is

CME, or it's

LME, but not both. So for me, one of the really interesting questions of our time is whether Britain can in fact succeed in transforming itself from an

LME country, into a

CME country. Given just how much manufacturing has shrunk as a percentage of British GDP, even just since 1990, the prospect seems doubtful.

There is this to be said, however. Even if "economic inequality" is not a major item on the political agenda in the United States, it is certainly something that Britain's political and economic elites are talking about. And they are trying to think it through at a very deep level. They realize that high taxation and income redistribution alone are not the answer, and that Germanic and Scandinavian countries are more egalitarian not just because they tax and redistribute. For Britain to become more egalitarian will require, instead, a complete overhaul of virtually every aspect of its economic model. And the really incredible thing is that there are now many people in Britain who are proposing exactly this. If Labor does get elected in Britain in the next cycle, the potential shift in policy priorities might be huge. But it's worth noting that not just Labor is thinking and talking this way. Even the Tories have expressed enormous admiration for various aspects of the German and Scandinavian model.

Britain is a country suffering prolonged crisis, and it has not managed to pull out of the 2008 melt-down as successfully as the United States. 5 years of recession are concentrating British minds powerfully, and many are concluding that only a complete overhaul of Britain's economic model will provide the basis for long-term, sustainable growth.

Furthermore, Britain has not been a world-hegemon for generations, it has reconciled itself to middle-power status, and so perhaps Britain is now more ready than the United States to learn from other countries and their political-economic successes? It also helps that Britain is located so close to the European continent, and so it's very easy for lots of Brits to experience

CME egalitarianism firsthand, in action. And not just elite policy-makers. Via “

sister city” and “

twin town” exchange programs sponsored by the EU, lots of British working class people have had a chance to see how their counterparts live on the continent, i.e. German, Dutch, Danish, and Swedish manufacturing workers – see

http://en.wikipedia.org/wiki/Twin_towns_and_sister_cities , and

http://en.wikipedia.org/wiki/Council_of_European_Municipalities_and_Regions .

Of course for Labor in particular, the superior economic justice and dignity that the

CME model accords all workers adds to its appeal. But still, to the wider public, even the Labor party does not tend to "sell"

CME as more likely to produce a just society, although clearly that's Labor's hope. Rather, Labor primarily touts the

CME model as more economically successful and stable; as the more "pragmatic" or "practical" alternative.

***************************************

4. A few more reasons why the United States will probably remain LME

***************************************

Although some American commentators are also now realizing all of the above, I strongly suspect that the United States will continue on its

LME path without deflection, if only because politically speaking it's the easier path, demands the least amount of thought, and requires the least overall of American institutions. And also because right-wing Republicans in the United States might be happier spending 25,000 USD per annum per prisoner incarcerating a huge percentage of America's poor, instead of developing a

CME politically economy that would turn them into productive workers via apprenticeship systems instead. Sure, this is economically and politically irrational, but it's a bit naive to expect any country to be economically or politically rational all the time. I also very much doubt that Republicans will support measures to turn the United States into a "full university participation" sort of society, as Labor in Britain tried to do in the 1990's and 2000's. All trends suggest exactly the opposite, in fact.

Often the argument is made that

LME countries are "demographically" superior to

CME countries, because they have higher rates of immigration, and because their more flexible labor markets seem better than

CME countries at absorbing Third-World immigrants, immigrants who have few skills, and can only find employment in poorly paid, dead-end, menial jobs. But this is an argument fraught with difficulties.

To me, this amounts to saying that the United States is superior because it has an economy that:

1. generates lots of "high-end" skilled jobs for native-born Americans from upper-class families, a "knowledge elite" who had access to excellent university educations and advanced degrees;

and

2. it also generates lots of "low-end", unskilled crap-jobs for cooks, waiters, nannies, gardeners, and tellers; jobs for Third-World immigrants who have come to constitute a veritable "servant class"; jobs they seem happy to take.

But if there are fewer and fewer jobs in the middle, jobs that might enable the children of immigrants to step up the ladder, and enjoy some hope of becoming middle or upper-middle class themselves, then this

LME model is not sustainable. The first generation of immigrants might be happy to do low-skilled crap-jobs for lousy wages, but not their children.

Furthermore, if there are no longer decent jobs in the middle, then native-born Americans who are not bright enough to attend university and join the "knowledge elite", will find themselves on a road to what the French call "

declassement", i.e. loss of class privilege. They will find themselves born into the American middle class, but falling gradually into in the lower middle class, and then the working poor, as middle-of-the-road jobs disappear. And who will they blame? You guessed it: low-skilled immigrants.

The

LME model seems to be creating a new kind of super-high-tech, massively class-stratified and unequal society, in which the owners of capital – i.e. the owners of the machines that are automating everything – enjoy an ultra-priveleged existence, while the remaining 90 % are left to perform increasingly menial crap-jobs, of the kind that have not yet been automated. This argument has been put forward most clearly by the French Leftist economist Thomas Piketty – see

http://en.wikipedia.org/wiki/Thomas_Piketty ,

http://www.parisschoolofeconomics.eu/en/piketty-thomas/ ,

http://www.economist.com/topics/thomas-piketty ,

http://en.wikipedia.org/wiki/Capital_in_the_Twenty-First_Century ,

http://www.economist.com/blogs/economist-explains/2014/05/economist-explains ,

http://www.economist.com/blogs/charlemagne/2014/04/thomas-piketty ,

http://www.economist.com/blogs/freeexchange/2014/07/thomas-piketty-history-money ,

http://www.theguardian.com/books/2014/jun/17/thomas-piketty-lse-capitalism-talk ,

http://www.theguardian.com/business...dishonest-criticism-economics-book-inequality ,

http://www.economist.com/blogs/freeexchange/2014/05/thomas-pikettys-capital ,

http://www.economist.com/blogs/freeexchange/2014/06/thomas-pikettys-capital , and

http://www.economist.com/blogs/freeexchange/2014/04/inequality .

It's as if United States is becoming a series of First-World research parks surrounded by a ghetto that's just as large, or larger. And no, I am not suggesting that the Third World is an American ghetto. Rather, I am suggesting large swathes of urban America are coming to resemble the Third World. Again, astute observers have been noticing this for quite some time, and the prominent German sociologist Ulrich Beck calls this development the "

Brazilianization" of the Anglosphere – see

http://www.answers.com/topic/brazilianization . Sure, in the Anglosphere lots of research goes on, lots of science, and lots of design and computer engineering. But comparatively little manufacturing, because low-end manufacturing is better performed by developing countries, and high-end manufacturing is better performed by advanced capitalist

CME countries. See the following

Economist article in particular, which addresses this point very clearly –

http://www.economist.com/node/18621224 .

Sure, elite "knowledge workers" in Anglosphere

LME countries enjoy incredible salaries and lifestyles. And because this Anglosphere elite continues to generate software companies like Google, it can afford to import lots of products manufactured by developing and

CME countries. But the Anglosphere elite is surrounded by a huge underclass of black Americans and recent Hispanic immigrants, as well as a shrinking white middle-class that has no hope of joining the elite, and that increasingly cannot afford those same products manufactured by developing and

CME countries.

Although this economic and sociological pattern seems disastrous, and really shocks European visitors when they first experience it, privileged Americans now seem mostly habituated to it, and do not seem sufficiently motivated to change it. It's perhaps too comfortable to be a well-paid American knowledge worker, making a terrific salary, paying low taxes, and being able to hire recently arrived, low-wage housekeepers and gardeners from Central American countries....

..And as long as the American elite remains too comfortable – and as long as it continues to apologize for America's

LME model because it seems to generate lots of low-wage jobs for housekeepers and gardeners – the United States is unlikely to change.

****************************************

CONTINUED IN NEXT POST

.

![IMG_2374[1].jpg IMG_2374[1].jpg](https://forum.expeditionportal.com/data/attachments/179/179862-3e5f2d915686fd34c7a40335c62ed9b6.jpg?hash=Pl8tkVaG_T)